The Tax Information for Retirement Plans webpage provides information for Retirement Plans Community, Benefits Practitioner, Plan Participant/Employee and Plan Sponsor/Employer.The Employer ID Numbers (EINs) webpage provides specific information on applying for an EIN, making a change in the application for an EIN, or canceling an EIN.The Internal Revenue Service issues employer federal identification numbers and administers federal payroll and income taxes, including social security, Medicare, federal unemployment insurance and federal income tax withholding. Provides a one-stop shop for tax assistance, including information about income tax, payroll tax, sales & use tax, and other taxes and fees for businesses. Responsible for the regulation of securities, franchises, off-exchange commodities, investment and financial services, independent escrows, consumer and commercial finance lending, and residential mortgage lending. California Department of Tax and Fee AdministrationĬalifornia Department of Tax and Fee Administration (CDTFA) administers more than 30 tax and fee programs that generate revenue essential to our state, including sales & use taxes. The California Franchise Tax Board administers personal and corporate income and franchise taxes for the State of California. State Agencies & Programs Franchise Tax Board While other state and local agencies may issue licenses and permits and assess fees or taxes, the following is a list of agencies that can assist you in determining your tax obligations and provide you with information about tax reporting and taxpayer rights. When you apply for an EIN, we presume you’re legally formed and the clock starts running on this three-year period.There are several agencies that administer a variety of taxes for businesses in the State of California.

Nearly all organizations are subject to automatic revocation of their tax-exempt status if they fail to file a required return or notice for three consecutive years. Note: Don’t apply for an EIN until your organization is legally formed. You should contact your state revenue department for additional information about tax-exempt numbers. The EIN is not your tax-exempt number. That term generally refers to a number assigned by a state agency that identifies organizations as exempt from state sales and use taxes. Specifically, a TIN may be a Social Security Number (SSN), Employer Identification Number (EIN), Individual Taxpayer Identification Number (ITIN), or Adoption Taxpayer Identification Number (ATIN). For more information about EIN application procedures, see Question 4 of FAQs regarding Applying for Tax Exemption. What is a TIN The term TIN is defined as the identifying number assigned to a person under Internal Revenue Code, Section 6109. territories. Make sure that you select church or church-controlled organization or other nonprofit organization as the type of entity.

You may also apply by telephone if your organization was formed outside the U.S. You can apply for an EIN on-line, by mail, or by fax.

Irs contractor ein look up pdf#

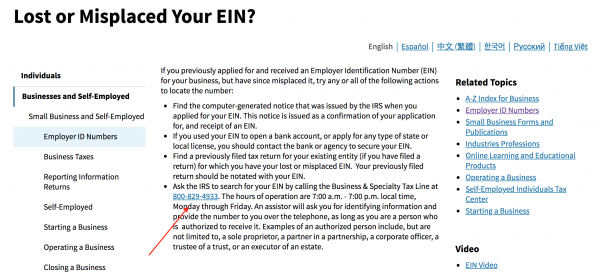

To apply for an employer identification number, you should obtain Form SS-4 PDF and its Instructions PDF. Every organization must have an employer identification number (EIN), even if it will not have employees. The EIN is a unique number that identifies the organization to the Internal Revenue Service.

0 kommentar(er)

0 kommentar(er)